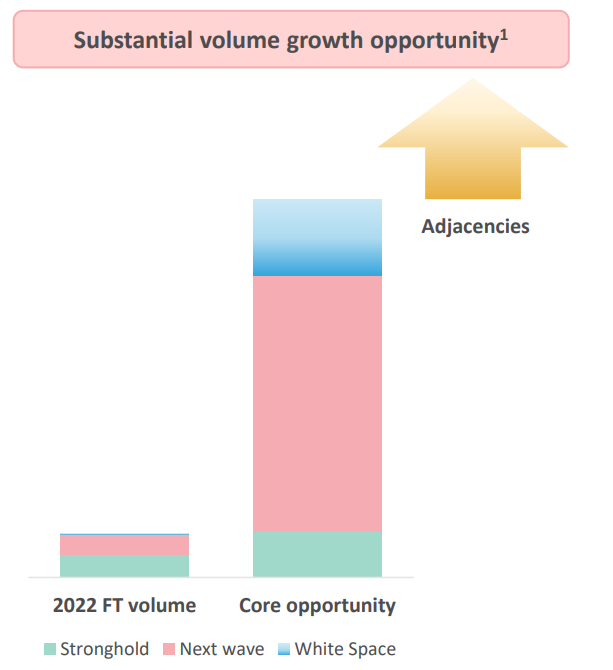

Long Term Opportunity

FEVER-TREE IS AT AN EARLY STAGE OF THE TOTAL OPPORTUNITY

WE HAVE BUILT A BROADER, MORE DIVERSIFIED GLOBAL PLATFORM

Stronghold markets (incl. UK, Belgium, Denmark): we have a high market share in carbonated mixers, with significant adjacent opportunities in cocktail mixers and adult soft drinks

Next Wave markets (incl. US, Italy, Australia): Fever-Tree is driving growth of premium mixers using our first mover advantage, premium price point and investment in marketing, supported by macro trends

Europe: premium spirits market is 1.5x the size of the UK and continues to premiumise2

üFever-Tree has c.15% value share of the European retail mixer market3

üDistributor model enables fast growth

US: premium spirits market is 11.5x the size of the UK and continues to premiumise whilst the premium mixer category is half the size of the UK, but growing, driven by Fever-Tree4

üFever-Tree has c.5% value share of the US mixer market5: equivalent to the UK in 2014

üExclusive premium mixer partner of Southern Glazer’s

White Space markets (incl. Asia, LatAM): we are seeding the brand to ensure we have first mover advantage

1Chart based on Group estimates – methodology based on mixability of premium carbonated mixers to premium spirits alongside underlying category growth assumptions – chart not to scale; 2IWSR (Spirit categories: gin, vodka, rum, whiskey, tequila), Nielsen, Statista 2019; 3Nielsen; 4IWSR; IRI 2019, CGA, Nielsen and Fever-Tree estimates; 5Nielsen